1 Morning Consult - The 15 Most Trusted Brands Globally. March 2021. Morning Consult surveyed over 330,000 consumers across 10 international markets to provide a global view on the current state of consumer trust across brands.

2 IDC. An IDC Thought Leadership White Paper, Commissioned by PayPal. June 2021. IDC partnered with PayPal to study how ecommerce-enabled enterprises in the US are adapting to today’s digital economy and which business-level objectives are driving technology investments.

3 An online study commissioned by PayPal and conducted by Netfluential in November 2020, involving 1,000 US online shoppers ages 18-39 (among PayPal users, n=682).

4 Available on eligible purchases. Limits apply.

5 About Pay in 4: Loans to California residents are made or arranged pursuant to a California Financing Law License. PayPal, Inc. is a Georgia Installment Lender Licensee, NMLS #910457. Rhode Island Small Loan Lender Licensee.

6 81% of Millennial and Gen Z BNPL users decide which payment method to use before checkout. TRC online survey commissioned by PayPal in April 2021 involving 5,000 consumers ages 18+ across US, UK, DE, FR, AU (among Millennial & Gen Z BNPL users (ages 18-40), US (n=222), UK (n=269), DE (n=275), AU (n=344), FR (n=150).

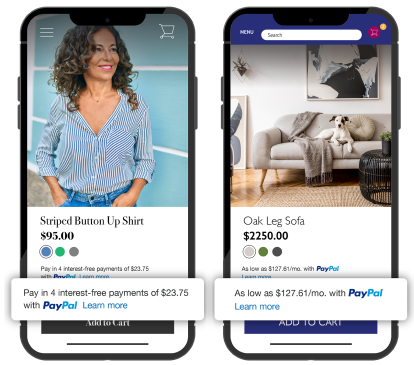

7 62% of BNPL users say that seeing a buy now, pay later message while shopping encouraged them to complete a purchase. TRC online survey commissioned by PayPal in April 2021 involving 5,000 consumers ages 18+ across US, UK, DE, FR, AU (among BNPL users, US (n=282), UK (n=303), DE (n=342), AU (n=447), FR (n=255)).

8 PayPal's Buy Now, Pay Later is boosting merchant's conversion rates and increasing cart sizes by 39%. PayPal Q2 Earnings-2021.

9 80% of BNPL users agree that seeing a BNPL message while browsing gives them the ability to spend more. An online study commissioned by PayPal and conducted by Netfluential in November 2020, involving 1,000 US online shoppers ages 18-39. (Among BNPL Users, n= 357).

10 74% of BNPL users are more likely to shop at a merchant again if they offer a buy now, pay later option. TRC online survey commissioned by PayPal in April 2021 involving 1000 US consumers ages 18+ (among BNPL users, n=282).

11 An online study commissioned by PayPal and conducted by Netfluential in November 2020, involving 1,000 US online shoppers ages 18-39.

12 TRC online survey commissioned by PayPal in April 2021 involving 1000 US consumers ages 18+ (among BNPL users, n=282).

13 An online study commissioned by PayPal and conducted by Netfluential in November 2020, involving 1,000 US online shoppers ages 18-39. (Among BNPL Users, n= 357)

14 TRC online survey commissioned by PayPal in April 2021 involving 1000 US consumers ages 18+ (among Millennial & Gen Z BNPL users (ages 18-40), n= 214).

15 Focus Vision, Commissioned by PayPal October 2020. The Venmo Behavior Study explores valuable insights for merchants to consider to reach a broader audience including 2,217 Venmo customers’ financial habits, purchasing behaviors, and perceptions of Venmo as a payments tool.

16 Statistia Global Consumer Survey as of July 2020. The target population are internet users in the U.S. between 18 and 64 years of age.

17 Q1 2021 PayPal Quarterly Results reported May 5, 2021.

18 Kelton Research, commissioned by PayPal, survey of 2,115 American adults, June 2018.