If it’s your first time running an advertising campaign, you’re probably wondering how much you should spend. I wish I could give you a simple answer, but I couldn’t without knowing the specifics of your business.

However, I can explain how to figure out how much you should spend on ads for yourself. The following information applies to all ecommerce ad campaigns. Whether you’re creating ads on Facebook, AdWords or anywhere else, this article will help you get started.

3 Questions to Decide How Much to Spend on Ecommerce Ads

To determine how much you should spend on advertising for your ecommerce store, you’ll need to answer the following three questions.

- How much does it cost to gain a new customer?

- How much is a new customer worth to you?

- How much can you afford to spend per new customer?

Let’s dig a little deeper into each one of those questions so you know what I’m talking about.

How Much Does it Cost to Gain a New Customer?

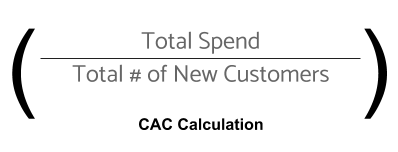

The amount it costs to gain a new customer is known as the Customer Acquisition Cost (CAC). Your CAC is calculated by dividing everything you spent over a period of time to acquire more customers (marketing budget, overhead, cost of goods sold) by the number of customers gained during that period.

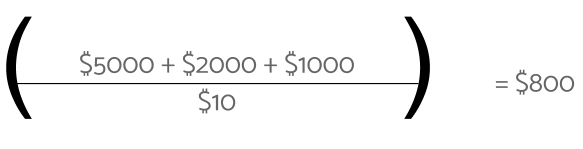

For example, let’s say that on average: * You spend $5000/mo on marketing * Your overhead is $2000/mo * You sell $1000/mo worth of product * You gain 10 customers/mo

You’d calculate your CAC like this:

How Much is a New Customer Worth to You?

The amount you can pay for a customer and still break even (long-term) is known as Customer Lifetime Value (CLV). It’s the average amount that a customer will spend at your store over the course of their lifespan as a customer.

Generally speaking as long as CLV > CAC, you’re making money.

Generally speaking as long as CLV > CAC, you’re making money (although that shouldn’t be your only concern, as we’ll see in the next section).

To determine the lifetime value of a customer, you’ll make the following calculations:

-

Divide your store’s total revenue in a year by the number of purchases that year to get the average purchase value.

-

Then, divide the total number of purchases for the year by the number of customers who made purchases during that year to get the average purchase frequency.

-

Multiply the average purchase value by the average purchase frequency during the year to determine the customer value.

-

Finally, multiply customer value by the average number of years a customer shops at your store (the average customer lifespan) to get the CLV.

Here’s what that looks like:

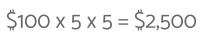

Here’s an example. Let’s say that on average:

- Shoppers spend $100 at a time at your store

- Shoppers shop at your store 5 times a year

- Shoppers shop at your store for 5 years

Based on those numbers, you’d calculate your CLV like this:

How Much Can You Afford to Spend Per New Customer?

Don’t go broke while you wait to break even.

To decide who much you can afford to spend, you need to know the payback period of your ad spend. In other words, how long will it take to recoup the money you spend on ads?

Think about it this way. If your CLV is $2,500, spending $800 to acquire that customer seems reasonable. But if it takes 5 years for the average customer to spend $2,500, how is that going to affect your business?

If you don’t have the cash flow to sustain your business while you wait ten years to break even, then you need to take that into account.

If you don’t have the cash flow to sustain your business while you wait ten years to break even, then you need to take that into account when determining your advertising budget.

One more factor to consider is your desired profit margin. Unless your only goal is growth, you’re probably looking to do more than just break even. How much profit do you need (or want)?

How Much Should You Spend on Ads?

Finally, the moment you’ve been waiting for. The answer to the $64,000 question: How much should you spend on ads?

First of all, if you’ll go broke waiting a year (or more) to earn the full value of a customer, you’ll want to calculate CLV differently. The math is the same, but you’ll want to pull data for the amount of months you can realistically wait to turn a profit.

Instead of dividing your store’s total revenue in a year by the number of purchases that year you’ll look at a smaller period of time.

Instead of dividing your store’s total revenue in a year by the number of purchases that year you’ll look at a smaller period of time. For example, dividing your store’s total revenue in a quarter by the number of purchases that quarter. Whatever makes sense for your business. Then you’ll do the same thing when calculating the average purchase frequency and customer value.

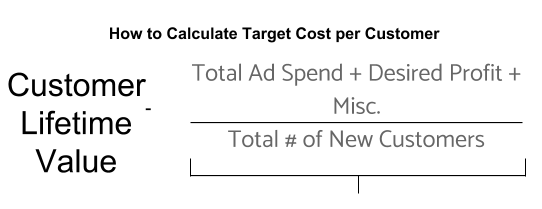

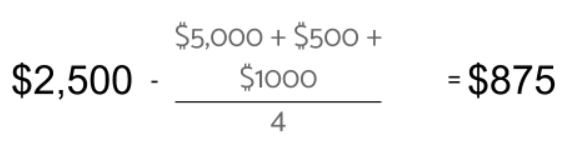

Based on your new CLV, you’ll calculate the maximum amount you should be willing to pay per customer with the following calculation (where “Misc.” could be overhead, cost of goods, and/or any other miscellaneous expenses):

Here’s one more example to illustrate that equation:

- CLV is $2,500

- Desired Profit is $500

- Overhead is $1000

- You spend $5,000

- You acquire 4 new customers

So in this case, your target cost per customer acquired is $875.

If that equation gives you a negative number, something needs to change.

Here’s a tip: if that equation gives you a negative number, something needs to change. Either you need to lower the amount you’re spending on ads, or increase your conversion rates so you can acquire more customers with the same ad spend.

If you’re not a math person, this ad spend calculator will help you determine a good target cost per acquisition..

The Golden Rule of Ad Spending

Your CLV should always be greater than your CAC. That’s the Golden Rule. But like all good rules, there are exceptions.

For example, as I’m writing this, MoviePass has a CAC that is way higher than its CLV thanks to their Unlimited plan.

They’re paying full price for up to one movie a day to acquire new users who only pay $10/mo. Even if their users are only seeing two movies a month, MoviePass is currently on the losing end of that transaction (and that’s before taking marketing and operating expenses into account).

Consider Your Objectives

Right now MoviePass is focused on growth, so (if their strategy is correct) acquiring all of these customers will lead to more money in the long run. They are focused on acquiring as many customers as they can as quickly as they can at this point.

Meanwhile, they have started looking for ways to increase their CLV through new products like selling ads to movie studios and advertising those studios movies to users who their data suggests would be interested in seeing them.

Before you spend a dime on advertising, determine your objectives.

Before you spend a dime on advertising, determine your objectives. Are you trying to grow your customer base? Or are you looking to drive revenue growth? Your target cost per customer will vary based on your goals.

If you read this in a year, MoviePass might not even be around anymore. And just like MoviePass, your strategy might be a winner or a loser. The important thing is that you have some sort of strategy so that you can measure your results to determine if it’s working or not.

By making the calculations set out above and determining your goals, you’ll be able to assess your ad campaigns and determine whether or not you need to change your strategy,

Do you have questions about adspend for your store? Ask them in the comments!