Whether you’re starting a new business or saving for a trip, creating a budget is a best practice that will also prove to be your best friend. There are a number of apps out there to help with budgeting and saving, but the micromanager in me has found that they aren’t quite as detailed or easy to organize as I like. Which is why I spent hours creating a customized budget spreadsheet to get in financial shape.

While a budget won’t magically fill your bank account, it will make it easier to save up bit by bit over time for the more exciting aspects of life. Here’s a peek into my own tried-and-true method of tracking and organizing finances.

Tab 1: Goals

This is the first thing I see when I open my budget doc. It’s simply a list of the things I’m saving for, which makes for great motivation when I’m trying to talk myself out of a night of expensive bar hopping.

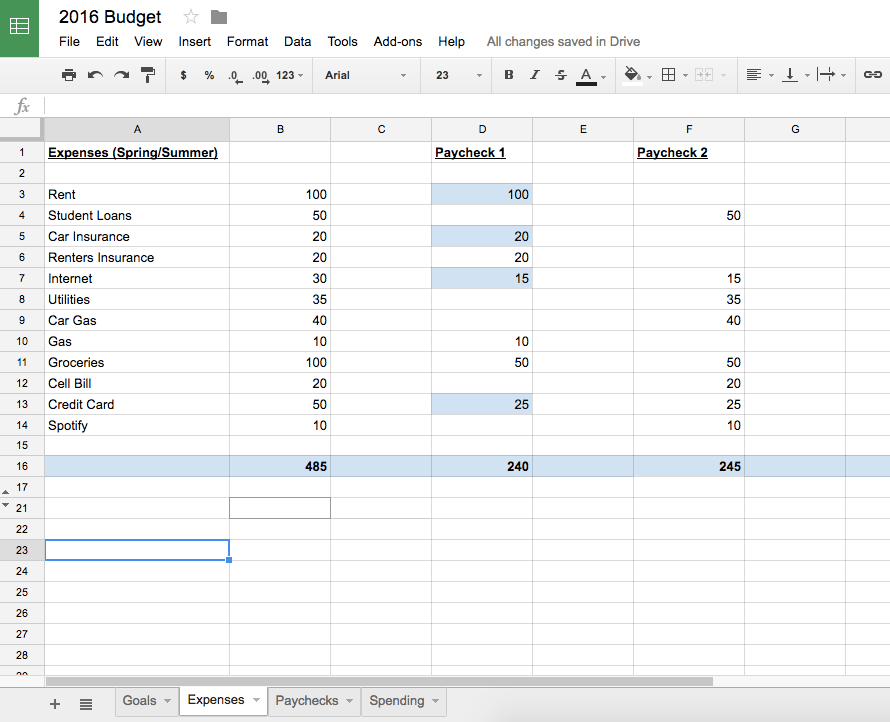

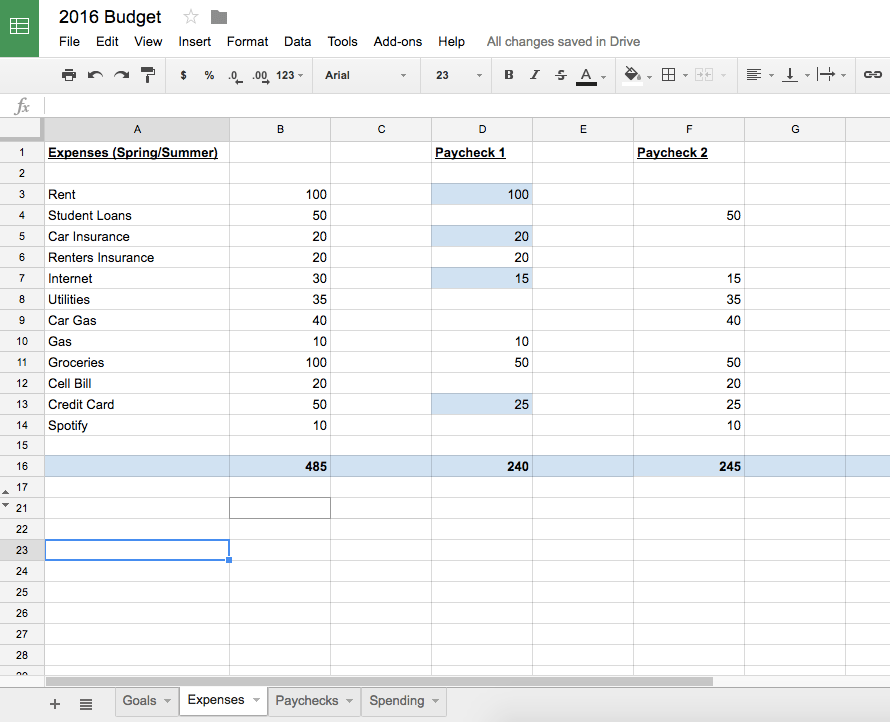

Tab 2: Expenses

This tab is where I list out my recurring expenses for each month. (No, this example is not how much my bills usually run. I wish!) I usually get paid twice a month, so I like to divvy out which expense is going under which paycheck. (Sometimes I split a higher bill between the two.) Whenever I’ve paid a bill for the month, I mark it in blue.

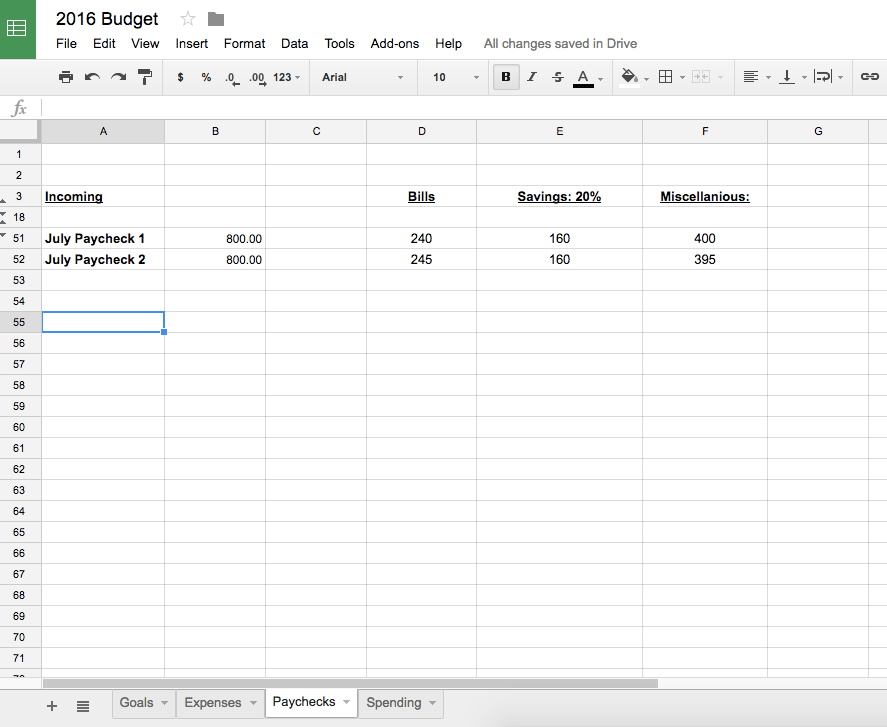

Tab 3: Paychecks

Here’s where I lay out each paycheck for the month and decide what’s going where. (And no, these aren’t my real paycheck numbers either!) The general rule for saving is to put aside 20% for savings, and to “pay yourself” first. This means that, before I pay any bills or even buy a cup of coffee, I throw 20% into my savings.

When budgeting, many people like to follow the 50/20/30 rule: 50% of a paycheck goes towards bills, 20% towards savings and 30% towards whatever else life throws at you. However, I like to just take my expenses from Tab 3 and plug them in the first column. That way my paycheck minus bills and savings equals the rest of the money I have for discretionary purchases. (Usually tacos.)

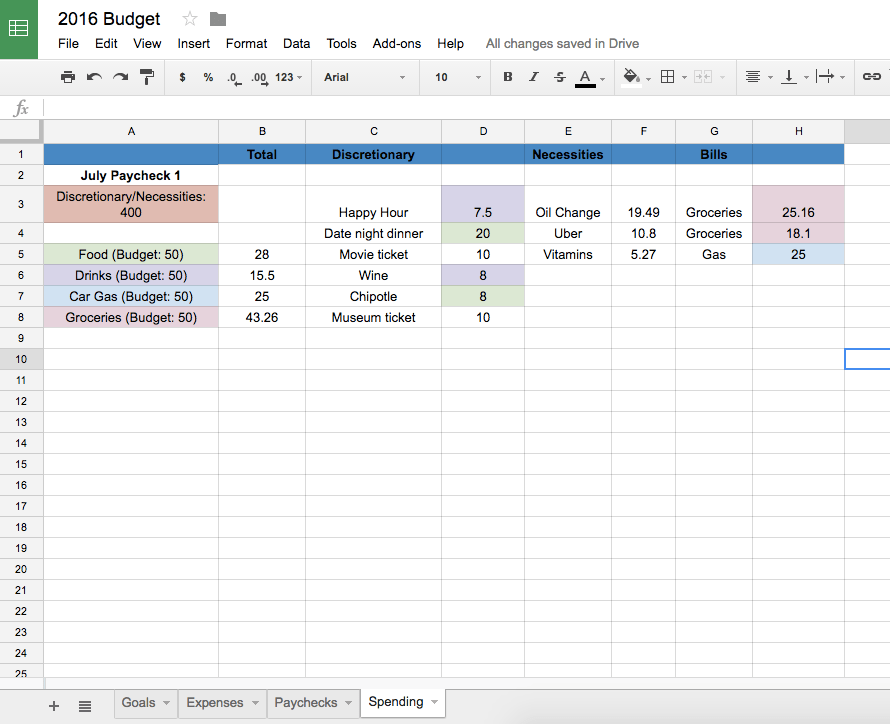

Tab 4: Spending

Tracking my spending has become ingrained into my daily routine. As soon as I open my computer in the morning, I log any purchases I made the day before. After all, what’s the point of a budget if you don’t keep track of where money is going?

The “Discretionary” column is everything I don’t have to spend money on. While I log all kinds of purchases here, I like to put a cap on some things that I tend to overspend on, namely eating out and the occasional trip to the bar. (I then total those purchases in the first column.) While I still go over budget sometimes, regularly logging what I spend usually keeps me in check.

The final two categories are relatively simple. “Necessities” accounts for things I have to spend money on that weren’t included in my bills budget. (There are usually a lot of Target trips in this column.) “Bills” is probably the most self-explanatory section: here I just keep track of bills that I have a budget cap on. (This prevents me from spending $20 on cheese at Whole Foods.)

So there you have it: my budget spreadsheet, which brings me the nerdiest kind of joy. While creating a document this detailed may take some time (and you may not enjoy doing it as much as I did), I’ve been using it religiously for the past year and have seen a dramatic uptick in my savings. Additionally, I never seem to be hurting as badly the day before my next paycheck, and I notice myself spending less on frivolous purchases. Saving and budgeting may be difficult, but it’s certainly a worthwhile endeavor!

Do you have any great budgeting tips? Share them in the comments!